capital gains tax increase in 2021

UK could be set for first white Christmas since 2010. The Biden administration has put forth a widely publicized plan to increase capital gains rates from 20 to 396 for the highest wage earners which likely includes agents and.

Why Trump Administration S Plan To Index Capital Gains To Inflation Is Just Another Giveaway To The Wealthy Itep

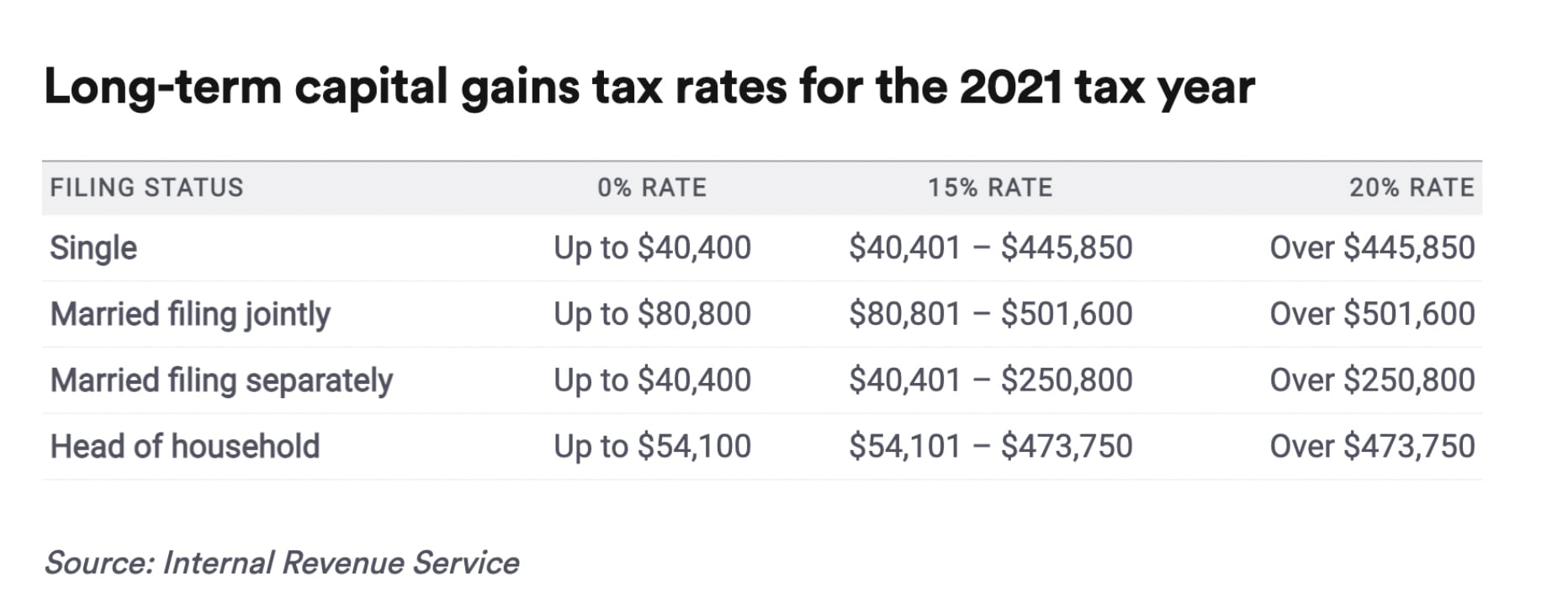

If you have a long-term capital gain meaning you held the asset for more than a year youll owe either 0 percent 15 percent or 20 percent in the 2021 or 2022 tax year.

. Its been paying dividends for more than 140 years and increased the payment for 25 consecutive years. As of September 7 2021 the share price is 3397 a year-to-date gain of. House Democrats propose raising capital gains tax to 288 Published Mon Sep 13 2021 333 PM EDT Updated Mon Sep 13 2021 406 PM EDT Greg Iacurci GregIacurci.

Capital gains taxes on assets held for a year or less correspond to ordinary income tax. As mentioned earlier the IRS taxes short-term capital gains are taxed at the ordinary income tax rate. In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year.

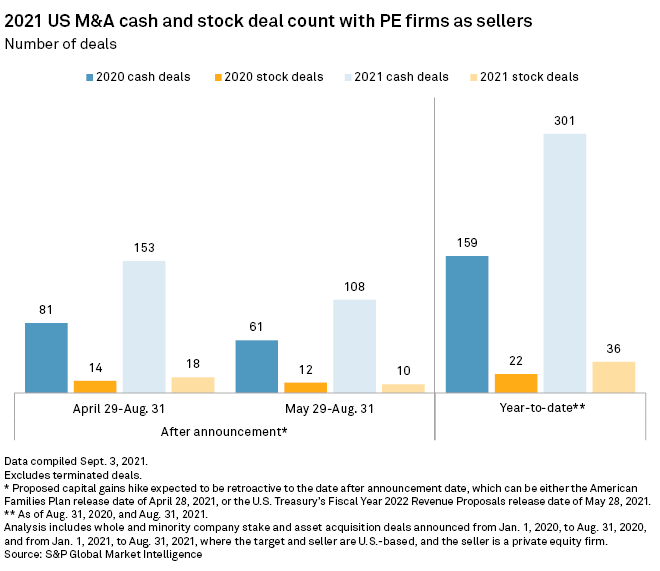

This means that high-income investors could have a tax rate of up to 396 on. This may be why the White House is seeking an April 2021 effective date for the retroactive capital gains tax increase as President Biden announced the proposal on April 28. In the Tax Reform Act of 1986 enacted October 22 1986 the tax rate on long-term capital gains was increased from 20 in 1986 to 28 in 1987.

In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. The gains that you make from the selling of your capital assets which you held for at least one year will be considered long-term gains and these can be taxed at anything from 0. This resulted in a 60 increase.

The proposal would increase the maximum stated capital gain rate from 20 to 25. 4 rows Youll owe either 0 15 or 20 on gains from the sale of most assets or investments held for. Capital Gains Tax Rate Could Be.

For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on. The tax hike would apply to households making more than 1. President Joe Biden proposed raising the top rate on long-term capital gains to 396 from 20.

Taxes and Asset Types -. Taxes and Asset Types - Investopedia 1 week ago Dec 21 2021 Capital gain is an increase in the value of a capital asset investment or real estate that gives it a higher worth. In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year.

Aside from annual inflation adjustments there arent any significant capital gains tax changes on tap for 2021. A Retroactive Capital Gains Tax Increase. Long-term gains still get taxed at rates of 0 15 or 20 depending.

The effective date for this increase would be September 13 2021. In 2021 a bill was passed that would impose a 7 tax on long-term capital gains above 250000 starting with the 2022 tax year. However it was struck down in March 2022.

Filers paid hundreds of billions more in taxes for 2021 and surging capital gains may have been to blame according to an analysis from the Penn Wharton Budget Model. If the Chancellor equalised capital gains tax with the rates of income tax this would push the top rate of capital gains tax to 45 the income tax rate for additional rate taxpayers. Tax Changes and Key Amounts for the 2022 Tax Year.

Biden Capital Gains Tax Rate Would Be Highest In Oecd

Preparing For Capital Gains Tax Increases In 2021 Diamond Associates Cpas

/capital_gains_tax.asp-Final-60dadf431693474ba6e99cd1f32440cd.png)

Capital Gains Tax What It Is How It Works And Current Rates

Capital Gains Taxes And The Impact On The Sale Of Privately Held Companies

The Tax Policy Agenda Preparing For Possible Capital Gains Tax Increase 8 3 2021 The Tax Policy Agenda What Businesses Need To Know

Crypto Capital Gains And Tax Rates 2022

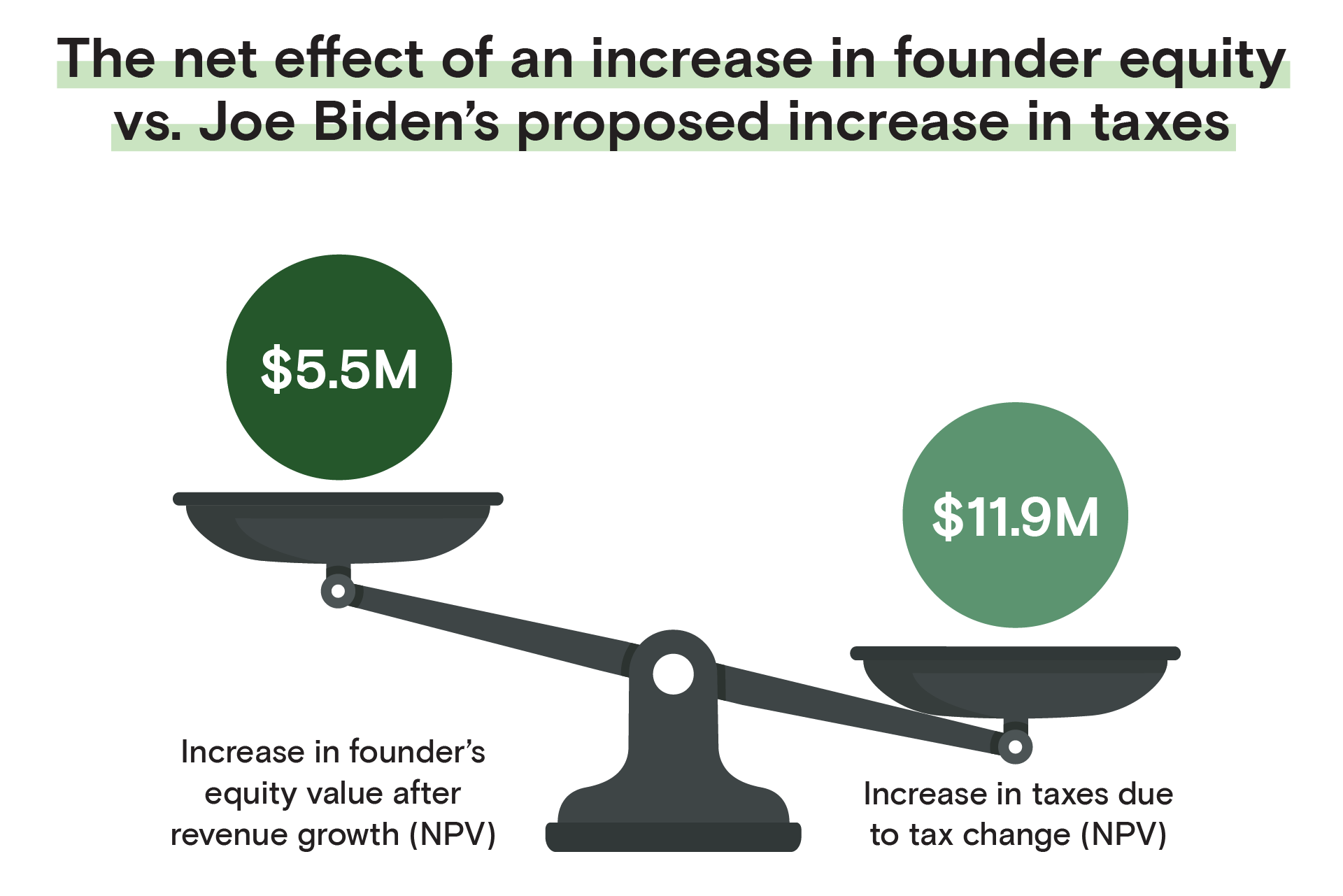

For Founders The Implications Of Joe Biden S Proposed Tax Code

Capital Gains Taxes And S P 500 Returns Complete Strangers For Over 60 Years

Capital Gains Tax What Is It When Do You Pay It

Capital Gains Nonsense Econlib

Capital Gains Tax Rates For 2022 Vs 2021 Kiplinger

Why A Capital Gains Tax Increase Would Be A Massive Jobs And Wealth Killer Foundation For Economic Education

California State Government Will Lose Big From Capital Gains Tax Increase Econlib

Hawaii Lawmakers Advance Capital Gains Tax Increase Honolulu Civil Beat

What You Need To Know About Capital Gains Tax

Higher Us Capital Gains Tax Proposal Spurs Pe M A Rush S P Global Market Intelligence

Short Term Vs Long Term Capital Gains White Coat Investor

Capital Gains Tax Archives Tek2day

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube